Covering everything from investment trends to the most expensive auctioned items, the Knight Frank Wealth Report includes all those interests and effects the affluent.

From investment trends to the most expensive auctioned items, the Knight Frank Wealth Report includes all those interests and effects the affluent. Based on insightful research and data analysis, the report covers global, political and economic concerns, wealth trends, property investment trends, luxury spending and more.

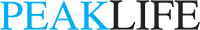

According to the report, the Indian Ultra-High-Net-Worth Individuals (UNHWI – people with a net worth of over US$30 Million, excluding their primary residence) population has grown by 30% in the past five years, according to data from GlobalData WealthInsight. This totals to 1,947 UHNWIs, out of which 61% of expecting their wealth to increase in 2019, showing confidence in the economic growth of the country.

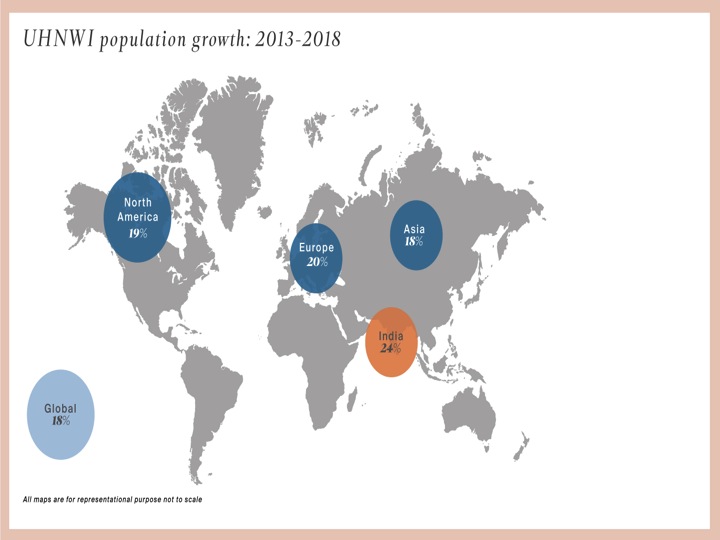

India is expected to see the highest UHNWIs growth in the world at 39% by 2023. Two-thirds of the world’s UHNWIs also saw their wealth increase in 2018.

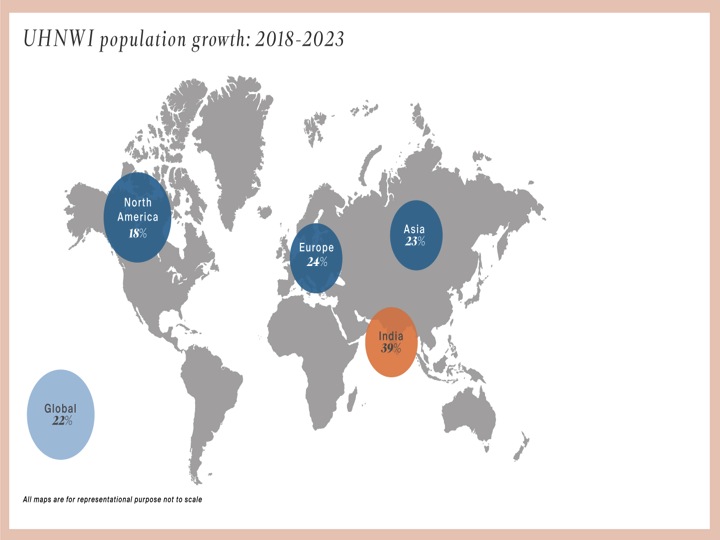

The investment portfolio towards asset classes in 2018 are:

- Equities (30%)

- Bonds (28%)

- Property (23%)

- Cash (9%)

- Private Equity (4%)

- Gold (4%)

- Luxury Investments (3%)

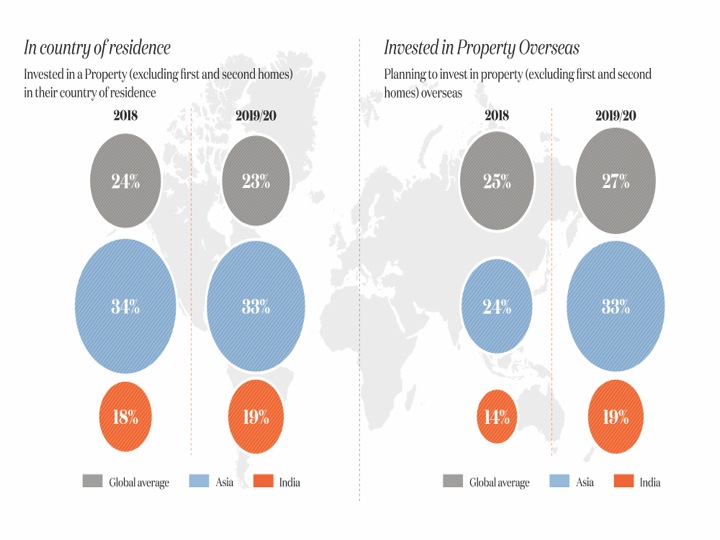

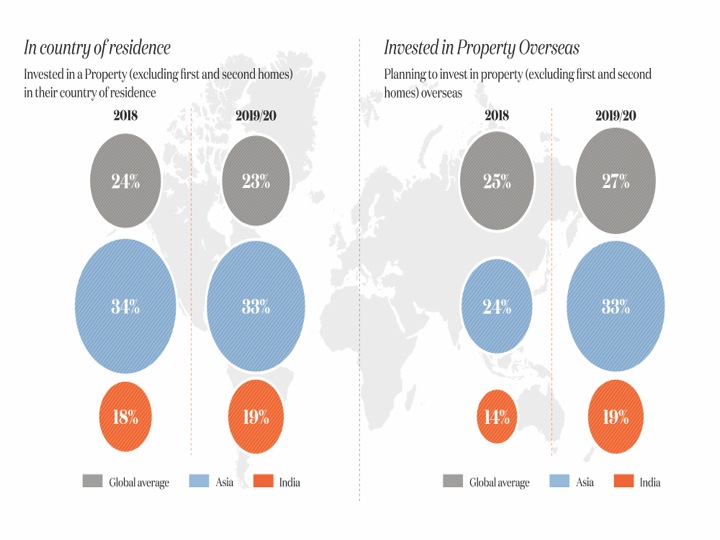

Indian UHNWIs allocated nearly a quarter of their wealth towards property purchase in 2018. Out of 1,947 Indian UHNWIs:

Indian UHNWIs allocated nearly a quarter of their wealth towards property purchase in 2018. Out of 1,947 Indian UHNWIs:

- 24% have property investments outside of India that exclude first and second homes

- 22% own second homes outside their country of residence

- The total wealth of 29% is allocated to properties they reside in, including first and second homes

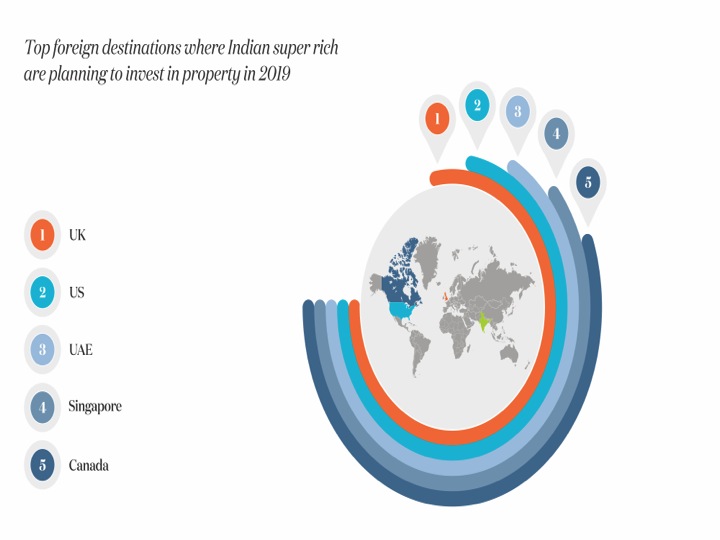

- 18% are looking to purchase a home outside the country of residence, with preferred destinations being

-

- UK (74%)

- US (39%)

- UAE (32%)

- Singapore (19%)

- Canada (16%)

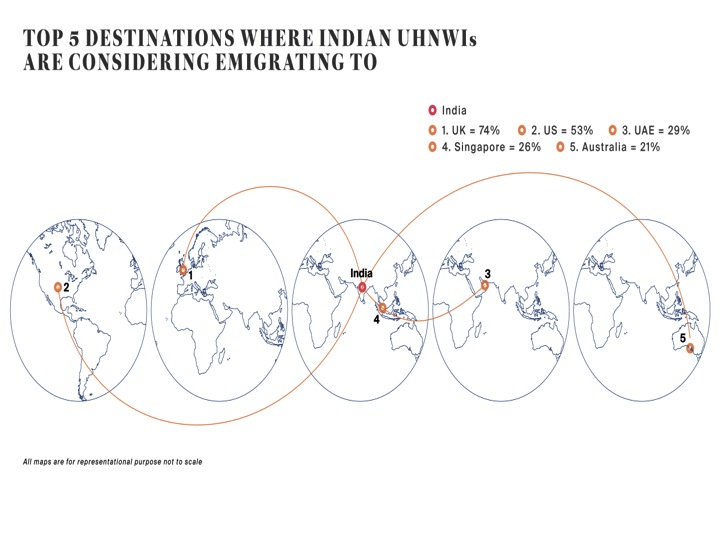

Emigration trends are:

Emigration trends are:

- For Indian UHNWIs, the top 5 preferred countries are:

- UK (74%)

- US (53%)

- UAE (29%

- Singapore (26%)

- Australia (21%)

- Globally, 26% of UHNWIs are considering emigrating permanently to another country. The top 5 preferred countries are:

- US (36%)

- UK (31%)

- Canada (20%)

- Australia (19%)

- Switzerland (16%)

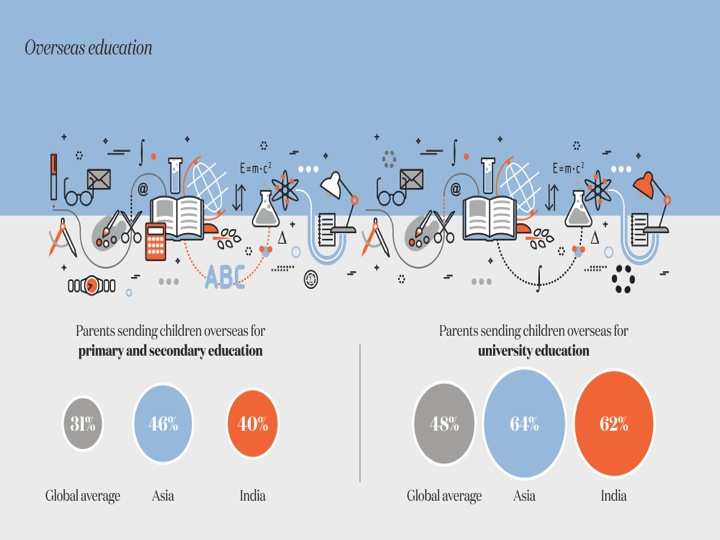

When it comes to education, in 2018:

When it comes to education, in 2018:

- 40% of Indian UHNWIs have sent their children overseas for primary and secondary education which is expected grow by 100% in the next few years

- 62% of Indian UHNWIs send their children overseas for university education

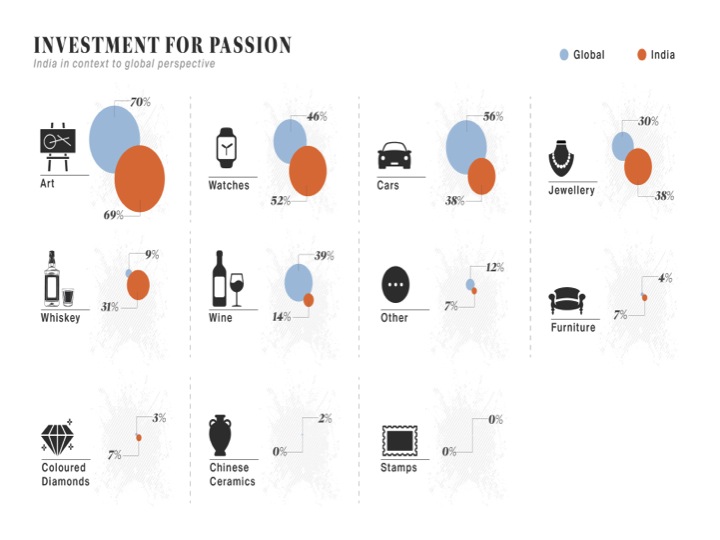

When it comes to investments for passion, India saw a 19% increase risk appetite towards investments in 2018.

When it comes to investments for passion, India saw a 19% increase risk appetite towards investments in 2018.

- Most collected investment for passion by Indian UHNWIs are

- Art (69%)

- Watches (52%)

- Cars (38%)

- Jewellery (38%)

- Whiskey (31%)

- Wine (14%)

- Coloured diamonds (7%)

- Furniture (7%)

- The global trends are:

- Art (70%)

- Cars (56%)

- Watches (46%)

- Wine (39%)

- Jewellery (30%)

- Whiskey (9%)

- Furniture (4%)

- Coloured diamonds (3%)

- Chinese ceramics (2%)

- 31% and 14% of Indian UHNWIs cite collecting Whisky and wine respectively, whereas wine is the global preference.

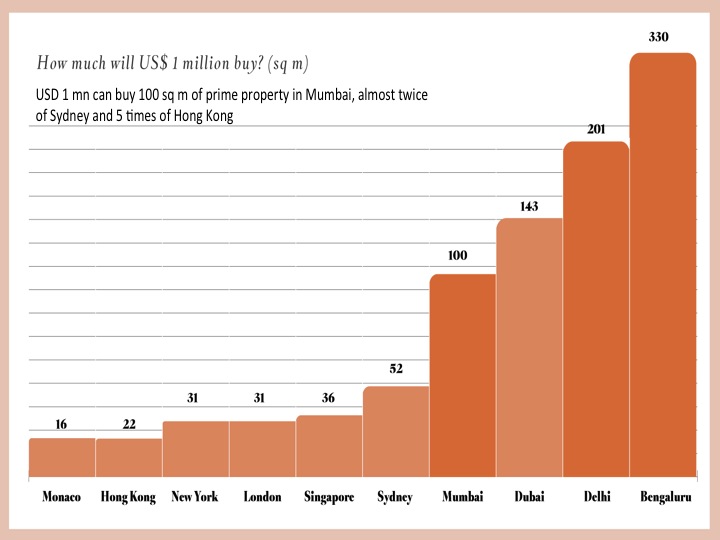

USD 1 million can buy 100 sq. mts. of prime residential space in Mumbai as compared to 90 sq. mts. in 2017.

USD 1 million can buy 100 sq. mts. of prime residential space in Mumbai as compared to 90 sq. mts. in 2017.

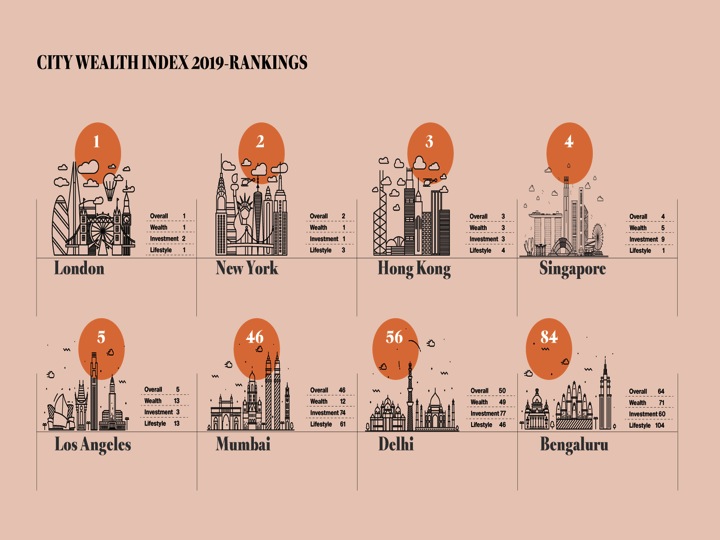

Bengaluru, the number 1 city of the future acoording to the report, is anticipated to attract increasingly high amounts of investors in the forthcoming years. Over the next five years, Oxford Economics data indicates a 60% growth in real GDP of the city and it also leads the UHNWIs growth forecast at 40%, while Mumbai and Delhi likely to see 38% growth respectively. Bengaluru is home to companies including Flipkart, Infosys, Wipro, over 400 multinationals including Microsoft, Hitachi and Samsung, and a thriving education economy. Often called India’s Silicon Valley, it offers several opportunities for future growth and innovation. Other cities of the future are Hangzhou, Stockholm, Cambridge and Boston.

Nicholas Holt, Head of Research, Knight Frank Asia Pacific, says, “Despite softening momentum in the region’s economies, growth prospects in Asia remain favourable in the medium term. While China’s economy is expected to slow, emerging markets such as India and the Philippines will deliver some of the strongest growth over the coming years.”