Your Guide to Get Rich: A Reading List for Better Wealth Management In a world where financial advice is as abundant as it is conflicting, how do we separate the wheat from the chaff? The answer lies in timeless wisdom penned by true experts

By Muskan

In the ever-evolving landscape of finance and opportunity, staying well-informed isn’t just an advantage—it’s a necessity. Whether you’re taking your first steps toward financial literacy or looking to refine your wealth management strategy, the right books can be your most valuable investment.

Imagine having a personal financial mentor—or better yet, ten of them—available at your fingertips, ready to share their hard-earned insights, time-tested strategies, and fresh perspectives on growing and protecting your wealth. That’s the power of the carefully curated list we’re about to explore.

From the fundamentals of saving to the intricacies of investing, from traditional financial wisdom to cutting-edge economic theories, these ten books offer a comprehensive education in personal finance and wealth management. Each volume has been selected not just for its content, but for its potential to transform your financial mindset and set you on the path to lasting prosperity.

Buckle up as we dive into this treasure trove of financial wisdom.

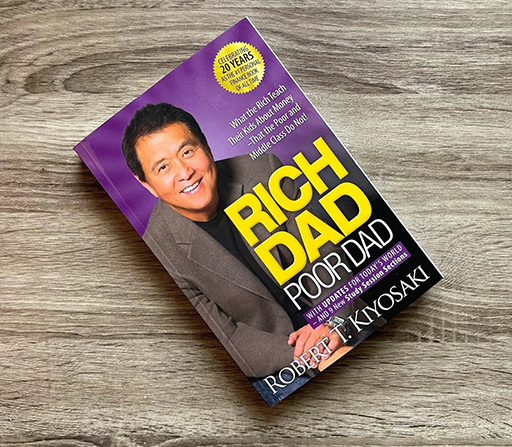

1. “Rich Dad Poor Dad” by Robert Toru Kiyosaki (1997)

Robert Kiyosaki’s “Rich Dad Poor Dad” burst onto the scene in 1997, challenging everything we thought we knew about money. This groundbreaking personal finance book weaves an intriguing tale of two father figures: Kiyosaki’s biological dad, the archetypal ‘Poor Dad’ — highly educated but financially struggling, and his friend’s father, the ‘Rich Dad’ — a street-smart entrepreneur with a gift for making money. Through this compelling narrative, Kiyosaki delivers a powerful message: when it comes to financial success, traditional education often misses the mark.

At its core, “Rich Dad Poor Dad” is a rallying cry for financial literacy. Kiyosaki argues that true wealth isn’t about working harder for money but about making your money work harder for you. The book’s genius lies in its ability to demystify complex financial concepts, making them accessible to readers from all walks of life.

Whether you’re just starting your financial journey or looking to take your wealth to the next level, Kiyosaki’s timeless wisdom offers a roadmap to success that continues to resonate with readers decades after its initial publication.

2. “The Intelligent Investor” by Benjamin Graham (1949)

Benjamin Graham’s “The Intelligent Investor,” first published in 1949, is the bible of value investing. This timeless classic introduces readers to the art of finding diamonds in the rough – stocks undervalued by the market but rich in potential. At the heart of Graham’s philosophy is the colourful allegory of Mr. Market, a character who embodies the daily mood swings of the stock market. Through this clever personification, Graham teaches investors to see beyond market hysteria and focus on a company’s fundamental value.

The book distinguishes between two types of investors: the cautious “defensive” investor and the more active “enterprising” investor. Regardless of your style, Graham’s wisdom on portfolio diversification and the pitfalls of speculation remains invaluable.

3. “Think and Grow Rich” by Napoleon Hill (1937)

Napoleon Hill’s “Think and Grow Rich” is the granddaddy of self-help finance books. Published in 1937, it distills the success secrets of the wealthy into a set of actionable principles. Hill’s extensive research into the lives of successful individuals forms the backbone of this timeless classic. At its core is the power of desire, faith, and the subconscious mind in achieving financial success.

The book introduces concepts like “organized planning” and the enigmatic “sixth sense,” presenting them as tools for unlocking your potential. Hill’s work isn’t just about making money; it’s a holistic approach to success that has inspired millions across generations. Whether you’re an entrepreneur, an employee, or somewhere in between, “Think and Grow Rich” offers a roadmap to harness your mental powers for financial growth and personal fulfillment. The book is extremely popular and has been translated into multiple languages.

4. “The Psychology of Money” by Morgan Housel (2020)

In “The Psychology of Money,” Morgan Housel dives into the complex relationship between our minds and our wallets. This 2020 release goes beyond traditional financial advice, exploring how our attitudes and behaviours shape our financial destinies. Housel weaves together engaging stories and insights to illuminate the often irrational ways we think about money.

The book tackles big themes: the roles of luck and risk in success, the magic of compound interest, and the illusion of control in unpredictable markets. Perhaps most poignantly, Housel emphasizes the importance of contentment, warning against the endless pursuit of wealth at the expense of happiness. It’s a fresh, thoughtful take on personal finance that will resonate with anyone looking to develop a healthier relationship with money.

5. “Common Stocks and Uncommon Profits” by Philip Fisher (1958)

Philip Fisher’s “Common Stocks and Uncommon Profits” is a cornerstone text for growth investors. Published in 1958, it remains as relevant today as it was then. The heart of Fisher’s philosophy is his famous “15 Points” – a comprehensive checklist for evaluating a company’s investment potential. These points cover everything from growth prospects and R&D effectiveness to management quality and profit margins.

Fisher champions qualitative analysis and advocates for a long-term investment approach. He encourages investors to look beyond the numbers, emphasizing the importance of understanding a company’s business model and competitive advantage. While some of Fisher’s contemporaries focused on finding undervalued stocks, he sought out high-quality companies with strong growth potential. For anyone serious about mastering the art of stock picking, this book is an indispensable guide to growth investing.

6. “I Will Teach You to Be Rich” by Ramit Sethi (2009)

Ramit Sethi’s “I Will Teach You to Be Rich” is the millennial’s guide to personal finance. Published in 2009, this book cuts through the noise with practical, actionable advice tailored for young adults. Sethi’s approach is refreshingly straightforward: he focuses on big wins rather than penny-pinching, advocating for automation and conscious spending.

From mastering credit cards to negotiating a raise, Sethi covers it all with a blend of humour and no-nonsense tactics. His emphasis on the power of compound interest and smart investing makes wealth-building feel accessible, even to financial newbies. If you’re looking for a finance book that doesn’t put you to sleep, Sethi’s work is your perfect bedside companion.

7. “Financial Peace Revisited” by Dave Ramsey (2003)

Dave Ramsey’s “Financial Peace Revisited” is more than just a money management guide—it’s a roadmap to financial and emotional well-being. This updated version of his 1992 classic draws from Ramsey’s personal journey from bankruptcy to financial success, offering readers a relatable path to follow.

At the heart of Ramsey’s philosophy are his famous “Baby Steps,” a simple yet powerful plan for achieving financial stability. From building an emergency fund to living debt-free, Ramsey’s advice is both practical and motivational. What sets this book apart is its holistic approach, addressing not just the numbers, but also the psychological and emotional aspects of money management. For those seeking financial peace of mind, Ramsey’s wisdom is a comforting beacon.

8. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

This is a groundbreaking study on the habits and lifestyles of America’s self-made millionaires. The book challenges the stereotypical image of the wealthy by revealing that most millionaires are not living extravagant lives filled with luxury. Instead, they tend to be frugal, disciplined and focused on long-term financial security. Based on years of research, the authors show that these individuals accumulate wealth through smart financial practices like budgeting, living below their means, and investing wisely. The book dispels the myth that high income equates to wealth and emphasizes that financial independence is often built through consistent savings and avoiding unnecessary expenses.

What makes this book an essential read is its practical, data-driven approach to wealth-building. It highlights that wealth is more often the result of deliberate planning and disciplined habits rather than luck or high earnings. The book encourages readers to adopt a mindset of financial responsibility, focusing on saving, investing, and living within their means. It’s particularly valuable for those seeking to change their relationship with money, showing that financial freedom is accessible through everyday decisions and long-term thinking.

9. “The Richest Man in Babylon” by George S. Clason (1926)

Nearly a century old, “The Richest Man in Babylon” remains a captivating introduction to personal finance. George S. Clason’s 1926 classic uses engaging parables set in ancient Babylon to impart timeless financial wisdom. Through these stories, readers learn fundamental principles of wealth-building that are as relevant today as they were in Clason’s time.

The book’s genius lies in its simplicity and storytelling approach. Key lessons include living below your means, paying yourself first, and investing wisely. Clason’s work doesn’t just teach financial concepts; it instills a wealth-building mindset that can transform your relationship with money. Short, accessible, and packed with wisdom, this book is the perfect starting point for anyone looking to master the basics of personal finance.

10. “A Random Walk Down Wall Street” by Burton G. Malkiel (1973)

This is a cornerstone text in investment literature. First published in 1973 and regularly updated since, this book challenges conventional wisdom about stock market prediction and investment strategies. Malkiel introduces readers to the Efficient Market Hypothesis (EMH), suggesting that stock prices reflect all available information, making it nearly impossible to consistently outperform the market.

But Malkiel’s work is far from a dry academic treatise. He delves into the psychology of investing, exploring how human behaviour can lead to irrational market movements. The book popularized the concept of index fund investing, a strategy that has since revolutionized the investment world. Whether you’re a seasoned investor or a curious novice, Malkiel’s insights offer a thought-provoking perspective on navigating the unpredictable world of Wall Street.

More from our site

Recent Posts

Shaping Tomorrow’s Golf Champions With Leela Palace Bengaluru

The 3rd edition of The Leela Golf Tournament celebrated young talent and brought together skill, precision and camaraderie!

The 3rd edition of The Leela Golf Tournament celebrated young talent and brought together skill,…

The Duo Behind KAIA Goa & Gigi Bombay, Redefines Hospitality

In conversation with the founders of Pawan Shahri and Nikita Harisinghani, the duo behind Chrome Hospitality Asia

In conversation with the founders of Pawan Shahri and Nikita Harisinghani, the duo behind Chrome…

Precision, Durability, and Swiss Legacy

Victorinox launches the Swiss Army collection, featuring three distinct models that emphasise exceptional quality, resistance and versatility

Victorinox launches the Swiss Army collection, featuring three distinct models that emphasise exceptional quality, resistance…

A New Era of Luxury Interiors With Sussanne & Gauri Khan

Sussanne Khan & Gauri Khan unite to bring an awe-inspiring, six-storey sanctuary of luxury, art, and design in Hyderabad

Sussanne Khan & Gauri Khan unite to bring an awe-inspiring, six-storey sanctuary of luxury, art,…

Air India x Lufthansa: Fly To These International Destinations Now

Expanding their codeshare partnership, Air India and Lufthansa Group have added 100 new routes to their combined network

Expanding their codeshare partnership, Air India and Lufthansa Group have added 100 new routes to…

Luxury’s Most Recent & Vibrant Launches This Season

The luxury landscape is brimming with bold innovations, striking partnerships, and immersive experiences

The luxury landscape is brimming with bold innovations, striking partnerships, and immersive experiences